Egyptian Expat Remittance

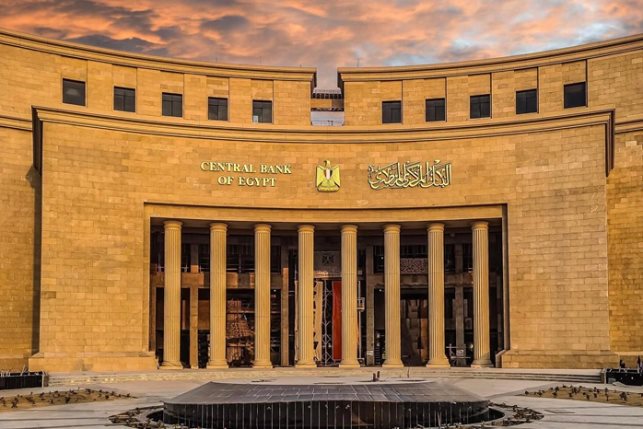

Egypt recorded $9.7B BoP surplus in FY2023/2024, pushed by March reforms | CBE

The overall surplus was largely driven by a substantial performance in the second half of FY2023/2024, where it soared to $10.1 billion, attributed to structural reforms implemented on March 6, 2024, which bolstered investor confidence

Current account deficit widens amidst capital inflows, surging 225% YoY | CBE

The deficit widened mainly due to a drop in Egypt's oil trade balance, which swung from a $1.7 billion surplus to a $5.1 billion deficit, driven by a decline in natural gas production that pushed oil and gas exports down by 61%

Egypt unveils ambitious 2030 strategy, prioritizes expanding FX inflows by 3x ($300B)

The document highlighted boosting exports, tourism and Suez Canal revenues, remittances, FDIs, and strengthening the outsourcing sector

Egyptian remittances drop by 29.2% in Q1 of FY23/24

The data further reveals that Egyptian remittances witnessed a decrease of 2% in the first quarter of the fiscal year (FY) 2023/2024, amounting to $4.523 billion

World Bank predicts Egyptian remittances to fall 15% YoY in 2023

The drop is attributed to the widening gap between the official and unofficial exchange rates, leading Egyptians abroad to utilize unofficial channels when sending remittances